Description

Company Description

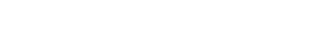

ARGOZ Consultants is a payments consulting firm that excels in optimizing scheme costs, interchange fees, and discount rates for issuers and acquirers, achieving savings of up to 15% on scheme costs and other related expenses. Our dual methodology encompasses consulting services that deliver in-depth cost analysis and bespoke optimization strategies, alongside AI-driven software solutions offering real-time tracking and comprehensive analytics. With a track record of assisting over 200 entities in 30 countries, we convert intricate financial data into actionable insights, enhancing efficiency and profitability. Collaborate with ARGOZ to unlock substantial cost savings and boost your financial performance.

***FAQs***

1. What services does ARGOZ Consultants offer?

ARGOZ Consultants focuses on optimizing scheme costs, interchange fees, and discount rates for financial institutions, such as issuers and acquirers. We deliver expert consulting services and AI-powered SaaS tools that provide thorough cost analysis, real-time tracking, and actionable insights to help our clients achieve substantial savings and enhance profitability.

2. How does ARGOZ help financial institutions reduce costs?

ARGOZ leverages advanced data analytics and machine learning to examine scheme invoices and pinpoint cost-saving opportunities. Our premier software, SAVVY, can decrease Visa and Mastercard fees by up to 15% by automating the analysis of billing events and offering actionable insights for cost optimization.

3. What challenges do ARGOZ's solutions address?

ARGOZ tackles several critical issues for financial institutions, including the complexity and opacity of scheme billing, inefficient resource utilization, and difficulties in comprehending business profitability. We also manage the intricacies involved in interchange fees and discount rates, ensuring institutions avoid profitability leakages. Our solutions simplify invoice analysis and transactional data, optimize transaction-related fees, and provide clear, actionable insights for more effective strategic decision-making.

4. Who can benefit from ARGOZ's services?

Financial institutions, including banks, fintech companies, and card issuers handling a large volume of credit card transactions, can benefit from ARGOZ's services. We target entities seeking to optimize their scheme costs and enhance profitability through effective cost management and strategic consulting.

Related Websites

-

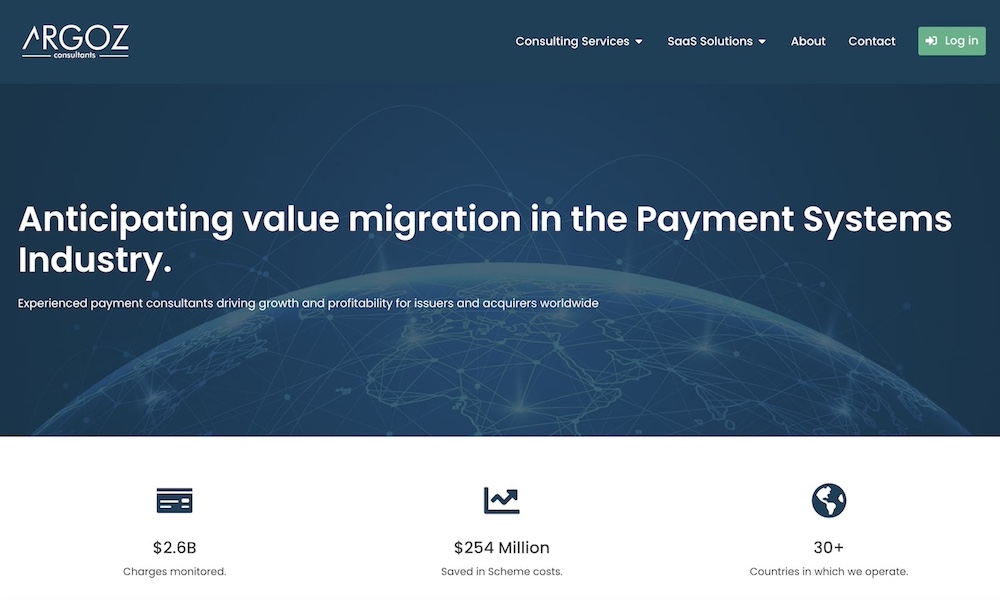

Alessio’s Gardens

by Alessio's Gardens

1154 -

Unified Business Web Solutions

by Unified Business Web Solutions Pvt. Ltd

878 -

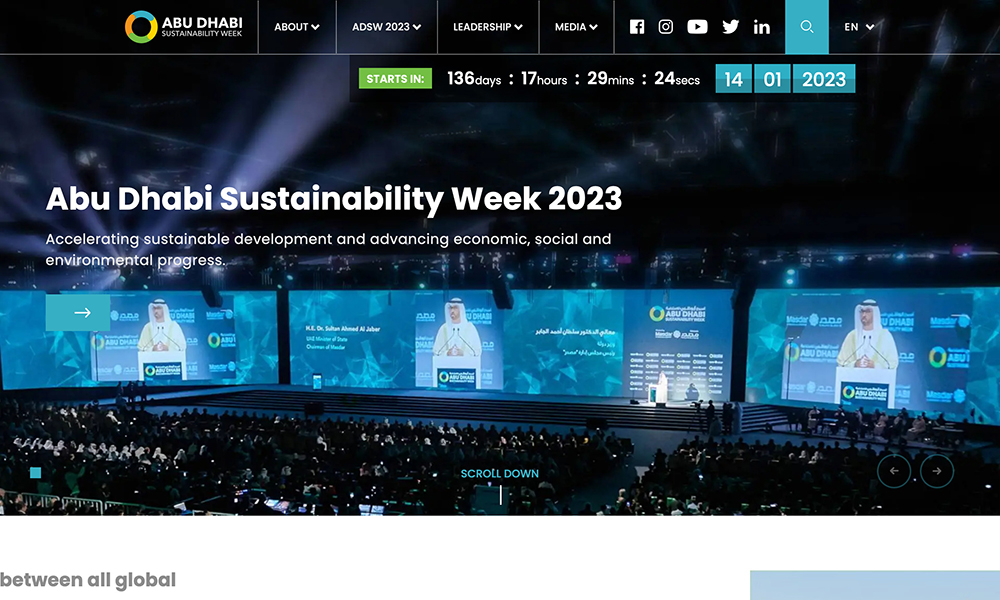

Abu Dhabi Sustainability Week

by Ab Dhabi Sustainability Week

993