Description

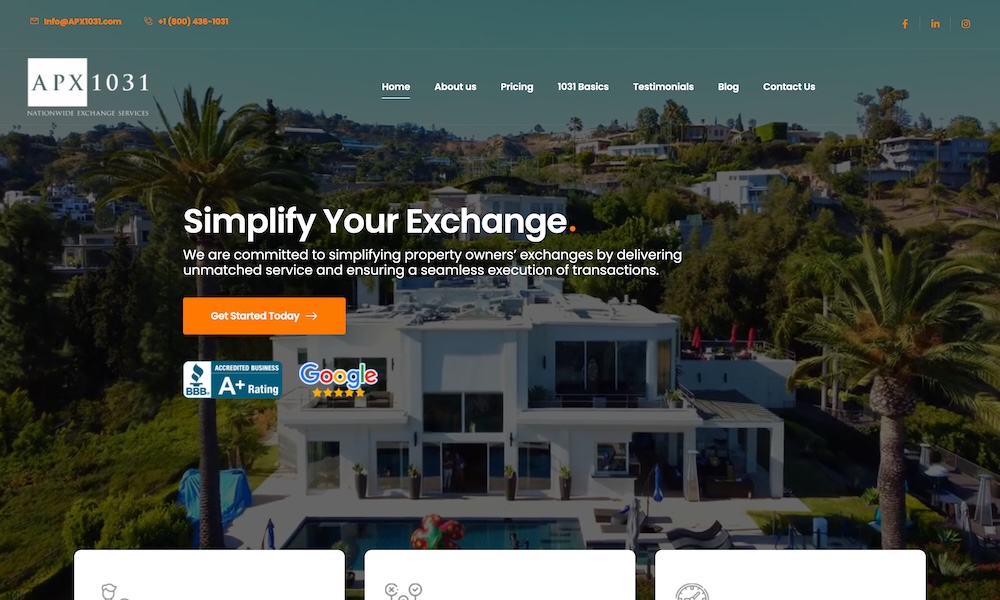

APX 1031 is a leading §1031 Exchange Accommodator (Qualified Intermediary) assisting property owners facilitate 1031 tax deferred exchange transactions nationwide. We offer a reliable and dependable means of safeguarding our client’s 1031 exchange funds in order to coordinate a successful 1031 tax-deferred exchange.

A Qualified Intermediary (QI), often referred to as a facilitator or an accommodator, is an unrelated, independent professional facilitator (third-party) authorized to receive and hold exchange funds (the sale proceeds) of the relinquished property and to facilitate the exchange – In accordance with IRS and Treasury Regulations.

By using a Qualified Intermediary to hold your exchange funds, this allows you to successfully execute the tax deferred exchange which prevents the exchanger from taking ‘constructive’ or (actual receipt) of the funds from the sale of the relinquished property (which would disqualify your 1031 Exchange transaction).

Related Websites

-

Progrynd

by Progrynd

241 -

DG & CO Jewellery

by DG & CO Jewellery

566 -

Skinhance

by Skinhance

134