Description

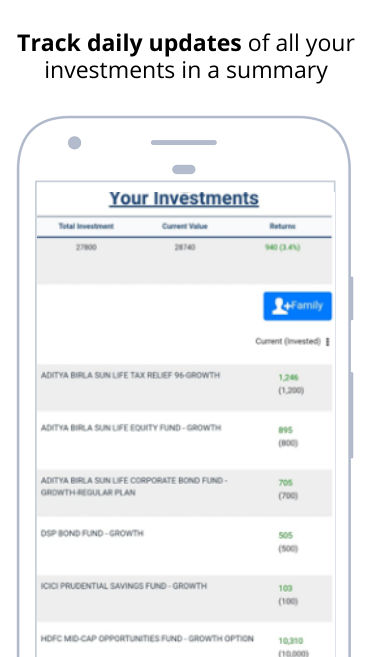

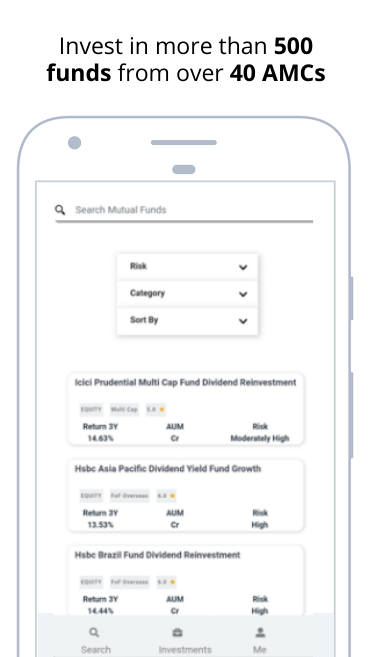

Investing in mutual funds | has become more easy and free with Wealth Bucket. Just in a few clicks reach the investment plans of mutual funds, no paperwork just hassle-free services. All mutual funds are easily available just in one investment app. With offering the benefit of investing in mutual funds, SIP with zero commission for free.

Invest in just few click

- Sign up in a minute, one time KYC processing within the app

- Buy and sell mutual fund smoothly

- Begin SIP with few clicks

Free online mutual fund investment

- Zero Pays, no transaction costs

- Enjoy all mutual funds plans

- Sell anytime, direct money transfer to your bank account

- -Start to invest with as low as Rs.100

Mutual fund investing for you

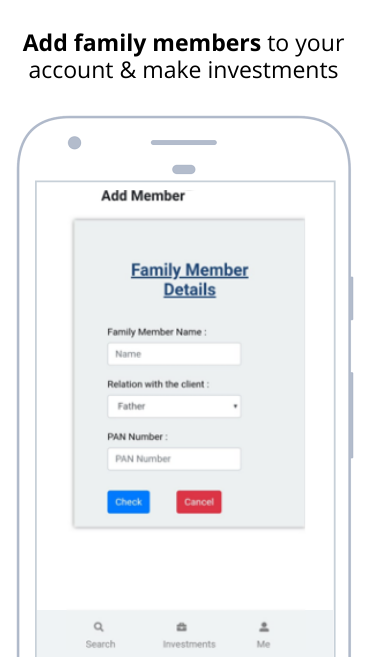

- Invest in the readymade packages of mutual funds suggested by experts

- View the historical performance of any mutual fund in the form of charts

- Topmost mutual funds list for various sections

- Latest investment news and insights

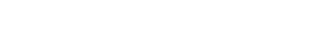

Mutual fund tracking and review

- Dashboard to track all your investments

- Trace your annualized and total returns

- Review details of holdings and mutual fund NAV

- Estimate returns through mutual fund SIP calculator

How to invest in mutual funds on WealthBucket?

- Verify your KYC

- Pick any mutual fund

- Begin SIP or one time- investment (lumpsum)

Investing for the success of goals

- Tax saving funds (ELSS mutual funds): Invest in tax saving mutual funds to gain tax exemption under section 80c. The total exempt limit is 1.5 Lakhs.

- Get more reliable plans than FD returns at low risk, start investing in liquid funds or ultra short-term debt funds. For earning higher long-term returns begin to invest in equity mutual funds - small-cap, large-cap, mid-cap, multi-cap. Or invest in balanced funds, gold funds, sector funds or international funds get whole basket funds in one mutual fund app.

- Mutual funds help you generate more returns on your money than fixed deposits or savings accounts. You can trade your investments anytime unlike real estate and gold. Check out SIP Calculator to understand how much returns you can earn.

- Safe and Reliable: Use the latest safety standards to retain your data secure and encrypted.

WealthBucket uses BSE star MF (Bombay Stock Exchange) for transactions. We trust our app with our own money. We support every RTAs - CAMS, Karvy, Sundaram, and Franklin. You can verify your units on mutual fund apps in India like MyCams and Karvy. You can also shift your funds to WealthBucket without any costs.

AMCs supported app-WealthBucket

Mutual Fund app including:

• SBI Mutual Fund

• Reliance Mutual Fund

• ICICI Prudential Mutual Fund

• HDFC Mutual Fund

• Aditya Birla Sun Life Mutual Fund

• Franklin Templeton Mutual Fund

• DSP Blackrock Mutual Fund

• Kotak Mutual Fund

• Mirae Asset Mutual Fund

• Axis Mutual Fund

• Motilal Oswal Mutual Fund

• L&T Mutual Fund

• IDFC Mutual Fund

• Parag Parikh Mutual Fund

• UTI Mutual Fund

• Sundaram Mutual Fund

• Tata Mutual Fund

and more…

Every main bank is supported for paperless SIP. One time-investment (lump sum) in mutual funds can be made through net banking. SIP investments are made by bank order.

You can easily track your investments from mutual fund apps like Investica, ETMoney, WealthTrust, Fundsindia, Scripbox, Paytm Money, Zerodha Coin, Angel Bee, Fund Easy, Asset Plus, Groww, Piggy Mycams, and MF Utility.

Enjoy investing in direct mutual funds

Reach us at support@wealthbucket.in or call us @ 8750005655

Related Apps

-

AOTD

Moon Invoice & Receipt Maker

by Moon Technolabs

1206 -

AOTD

blinkX-Stocks, IPO & Demat App

by JM Financial

1279 -

AOTD

Rubique- Apply for Credit Cards & Loans

by Rubique Technology

2023