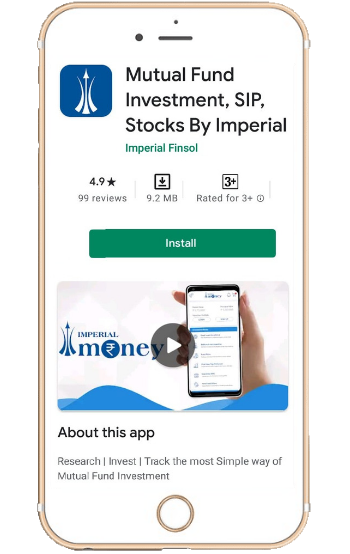

26 May 2021 App Of The Day

Imperial Money - Mutual Funds

by Imperial Money Pvt. Ltd.

Description

Imperial Money offers the simple, free & most convenient way for Mutual Fund Investment.

It’s all just on fingertips, No paperwork, No hassles, Do Mutual fund investment using Imperial Money. All Indian mutual funds are available in one single app. In Imperial money you can start SIP, lump-sum investment for free.

Switching of the funds from one fund to other fund and Systematic withdrawal plan or funds from liquid to equity or equity to liquid while re-balancing of the portfolio you can just do it here anytime anywhere you are.

- Investing becomes easy with your fingertips

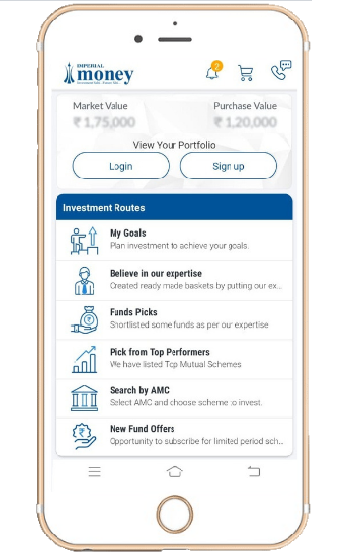

- Get Sign up in minutes,

- One time KYC process within the app

- Buy, Sell, Shift mutual funds within fund family.

- Buying Systematic investment plan or doing the STP or SWP is just simple and easy.

- Invest in all mutual funds online for free

You do not require paying any additional cost for buying funds from Imperial money!!

Most researched Mutual funds baskets are available.

Sell anytime - Money comes to your bank account directly

Learn mutual fund investment with as low as Amount of Rs.500/- with respect to your objective and planning of life the portfolio are builder for giving one of the state of art experience

- Mutual Fund Investment for You

- Simple Design, Easy to understand

- Made for beginners and experts both

- Financial Planning you can do it here itself

- Invest in the researched and ready-made basket of mutual funds recommended by experts with years together experience bringing for you.

- Latest finance news and insights, notifications

Most important is the teams of experts are available here to help you out in any type of Issues.

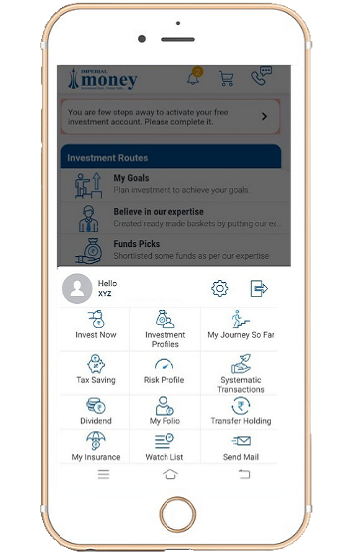

* Steps After Imperial Money App Install:

- Verify your KYC

* If the KYC is not available then use following process

- PAN/KYC

- Profile set up

- Make an investment of sip or lumpsum

- Need of KYC for mutual funds as per process of the Government of India

for making a Tax saving funds (ELSS mutual funds): Invest in tax saving mutual funds to get tax exemption under section 80c. The total exempt limit is 1.5 Lakhs.

Invest in equity mutual funds - small cap, large cap, mid cap, multi-cap - for the long term and higher returns. Check out SIP Calculator to know how much returns you can make.

Safe & Secure:

We use the latest security standards to keep your data safe and encrypted.

IMPERIAL MONEY is secure and does not store any information on your device or SIM card. Download and stay connected to your Mutual Fund investments always. Imperial Money uses NSE (National Stock Exchange) for transactions. We support all RTAs - CAMS, Karvy and Franklin.

Following AMC’s are supported on IMPERIAL MONEY Mutual Fund App:

SBI Mutual Fund,NIPPON Mutual Fund,ICICI Prudential Mutual Fund,HDFC Mutual Fund,Aditya Birla Sun Life Mutual Fund,Franklin Templeton Mutual Fund

DSP Mutual Fund,Kotak Mutual Fund, Mirae Asset Mutual Fund, Axis Mutual Fund

Motilal Oswal Mutual Fund, L&T Mutual Fund,IDFC Mutual Fund,INVESCO Mutual Fund

UTI Mutual Fund,Sundaram Mutual Fund,Tata Mutual Fund,ITI MUTUAL FUND,BNP PARIBAS MUTUAL FUNDS,EDELWEISSS MUTUAL FUND,HSBC MUTUAL FUND MAHINDRA MUTUALA FUND,PGIM MUTUAL FUND,PRINCIPLE MUTUAL FUND UNION MUTUAL FUND

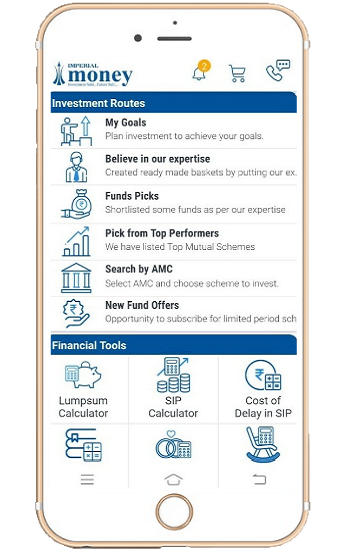

IMPERIAL MONEY - KEY FEATURES

Access your investments across multiple Mutual Funds through a Single Gateway; No more managing multiple PINs, Folios numbers, login ids;

- Mobile PIN & Pattern login – Simplified your Imperial Money App login process now. Just pick your preferred login methods – Mobile PIN, Pattern or Password right away

- Paperless Investing: Quick & paperless account creation and instant Activation. Within a couple of minutes, you are all set to ride the new wave of investing.

- Instant SIP: Once you are registered. It takes less than a minute to start a SIP.

- SIP Calculators: With the help of calculators plan your investment needs to achieve your Financial Goals.

Happy investing with Imperial money!!! Investment Sahi…Future Sahi...

Related Apps

-

AOTD

Logo Maker : Graphic Design Generator : Logo Art

by Sweet Sugar

5774 -

Winkdoc : Clinic Management

by ZimoTechnologies

881 -

AOTD

Currency Rates PRO

by Imagine Interactive

2968