Description

Home Credit, the most trusted Personal Loan App in India

● Loan Amount: ₹10,000 upto ₹5,00,000

● Minimum Annual Percentage Rate (APR): 24%, Maximum APR: 49.5%

● Minimum repayment period: 3 months, Maximum repayment period: 51 months

● Processing Fees: 2.5% to 5%

● Convenience Fees: 0 to Rs 250

● If customers opt for a Value-Added Service, the fee for the same shall be levied additionally

Representative Example

Loan Amount: ₹50,000

Tenure: 12 months

Interest Rate: 24%

EMI: ₹4728/month

Processing Fees: ₹ 1,000

Total Amount Payable: ₹4,728 x 12 months = ₹56,736

*The annual interest rates and processing fee will vary as per the risk profile of the customers.

The maximum APR can go up to 49.5% (However, only a fraction of our customers get an interest rate higher than 30% per annum).These numbers are indicative & subject to change.

Key Points :

• Over 1 Crore satisfied customers

• More than 31,000 Partners Shops

• Presence across India in 300+ Cities

What's New :Shop from our wide range of exclusive offers on Flipkart. Avail the best prices on Mobile Phones, Laptops, TVs, Apparels, Electronics, Accessories & many more. Get the products delivered right at your doorstep. Explore the world of online shopping on Flipkart and enjoy the benefits!

Products for You:

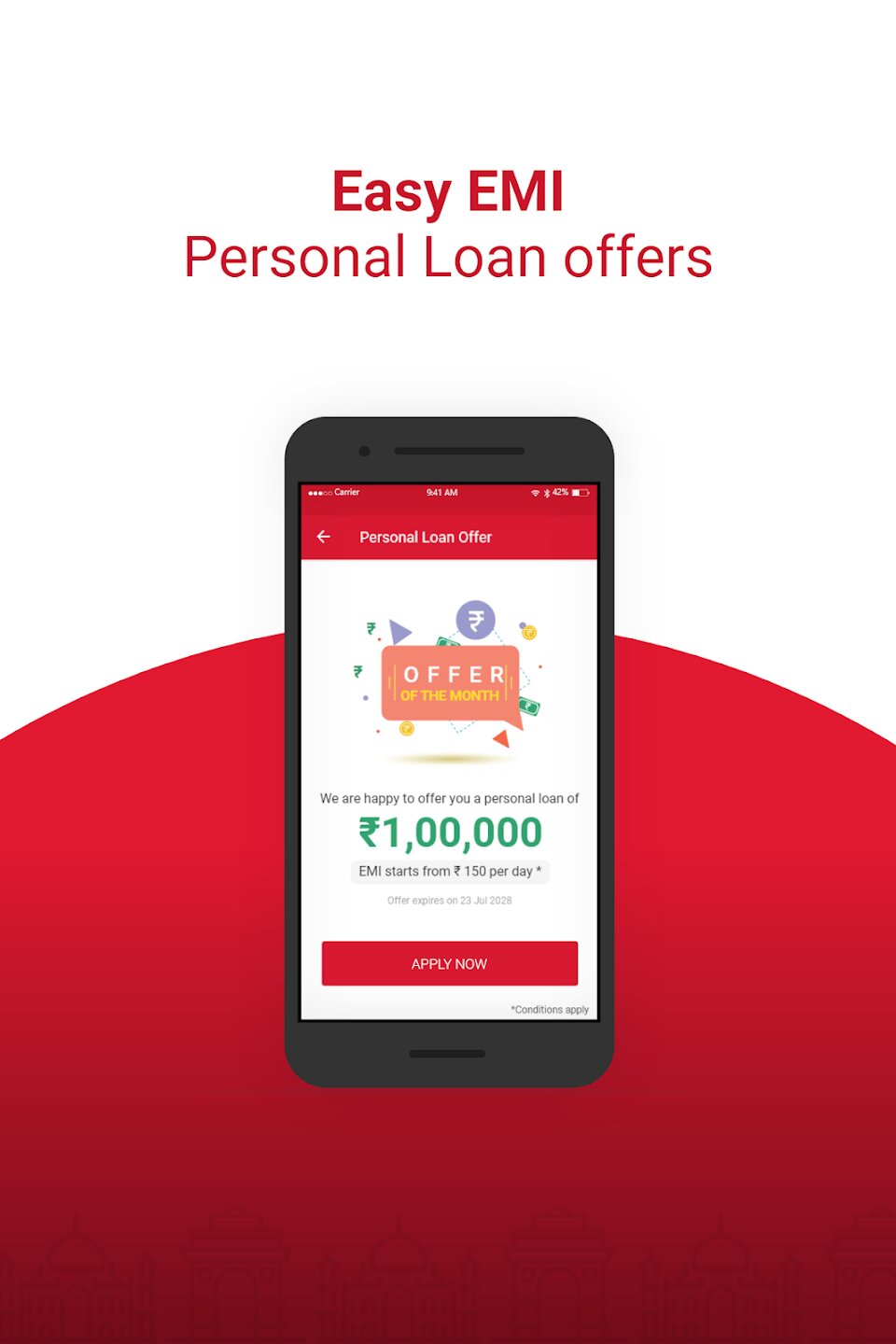

Personal Loan- Home Credit offers instant Personal Loan for your all needs such as Medical Emergency, Wedding, Small Business, Education, etc. Apply Personal Loan Online up to ₹5 Lakh with minimal documentation.

Home Appliance Loan- Get a Loan for Home Appliances like TV, Refrigerators, AC & many more on easy EMIs & flexible tenure.

Ujjwal EMI Card- Apply for an Ujjwal EMI Card & enjoy the benefits of a pre-approved limit of ₹ 75,000. Use this limit to buy products of your choice at more than 31,000 partner shops across India.

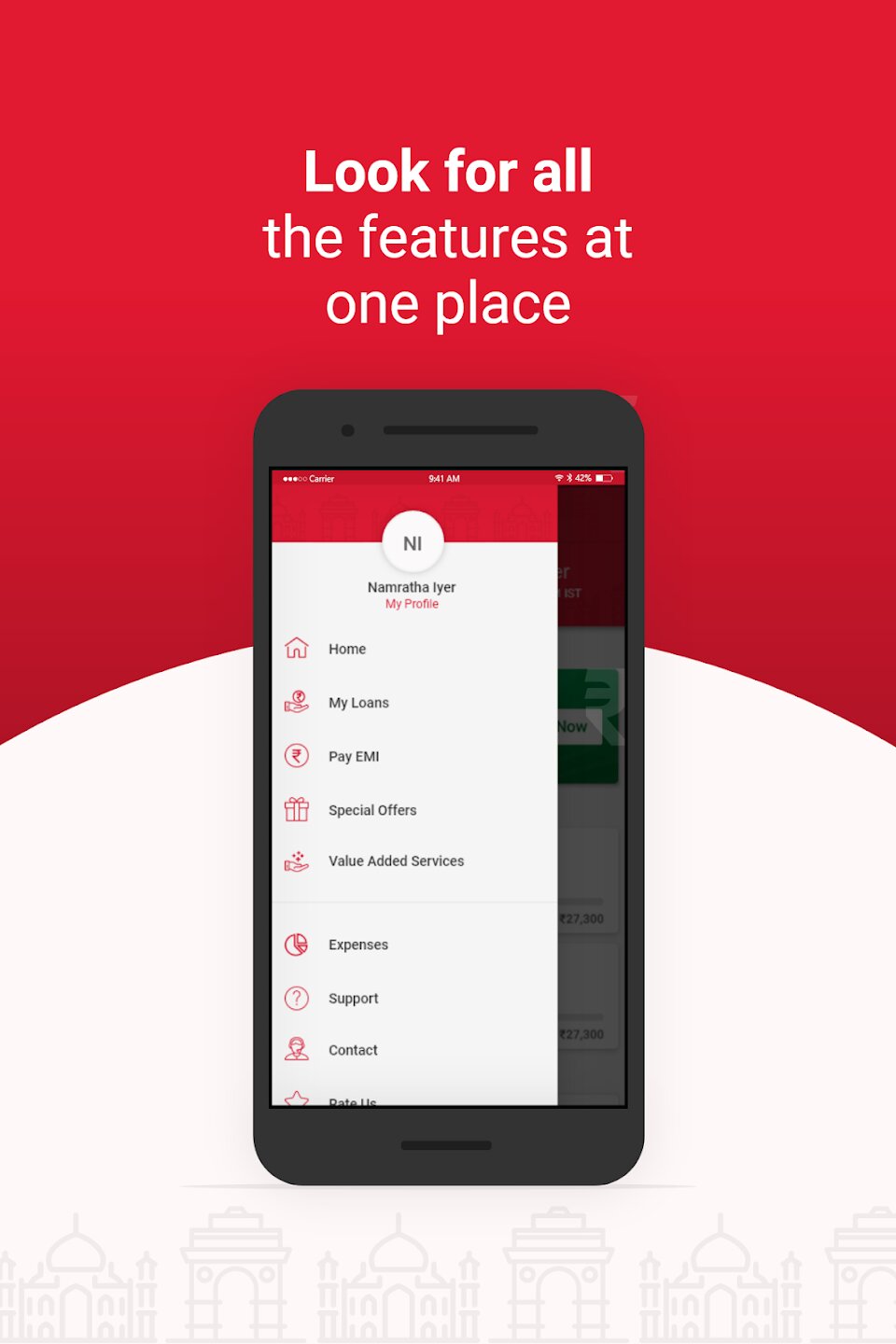

Add-on Features:

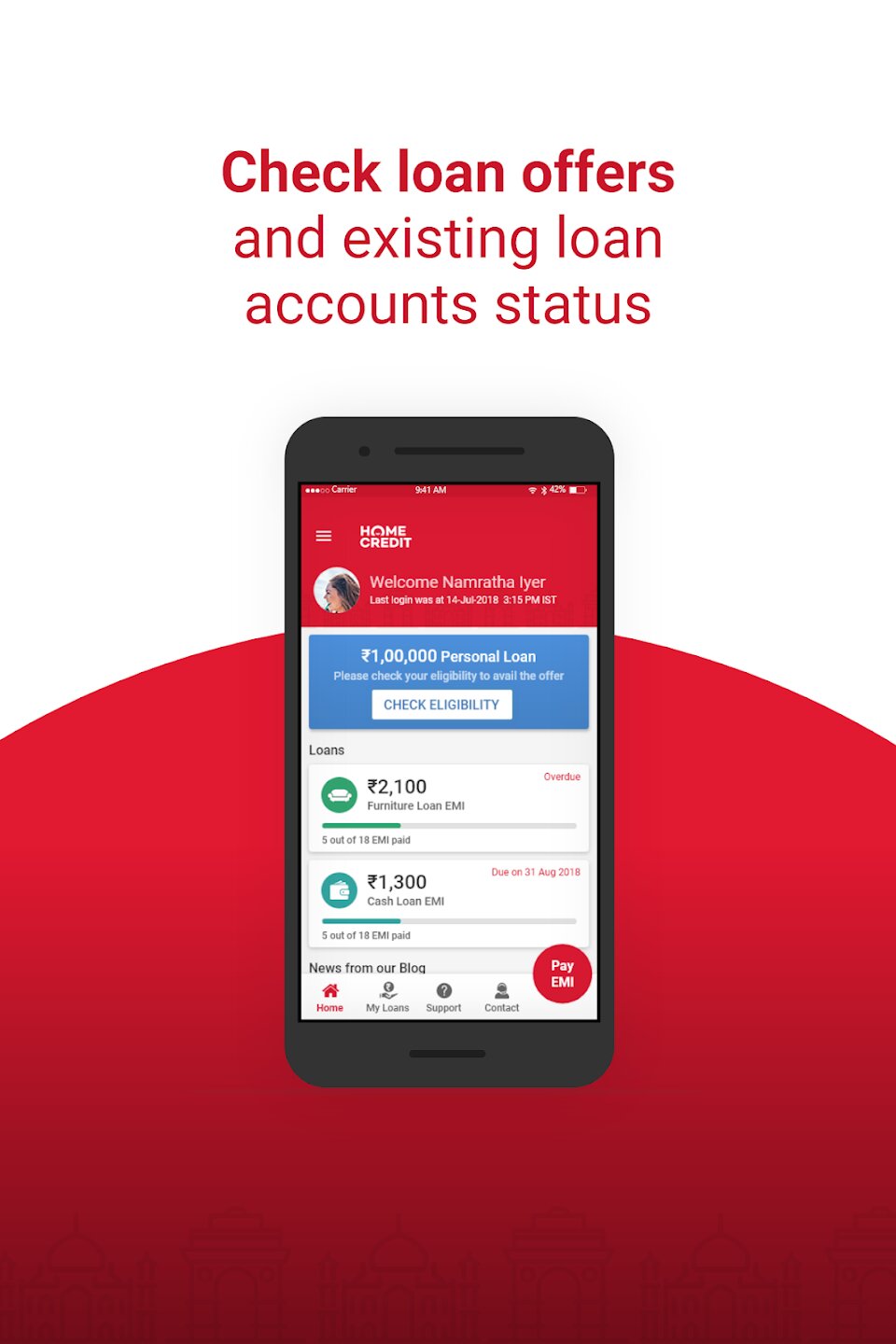

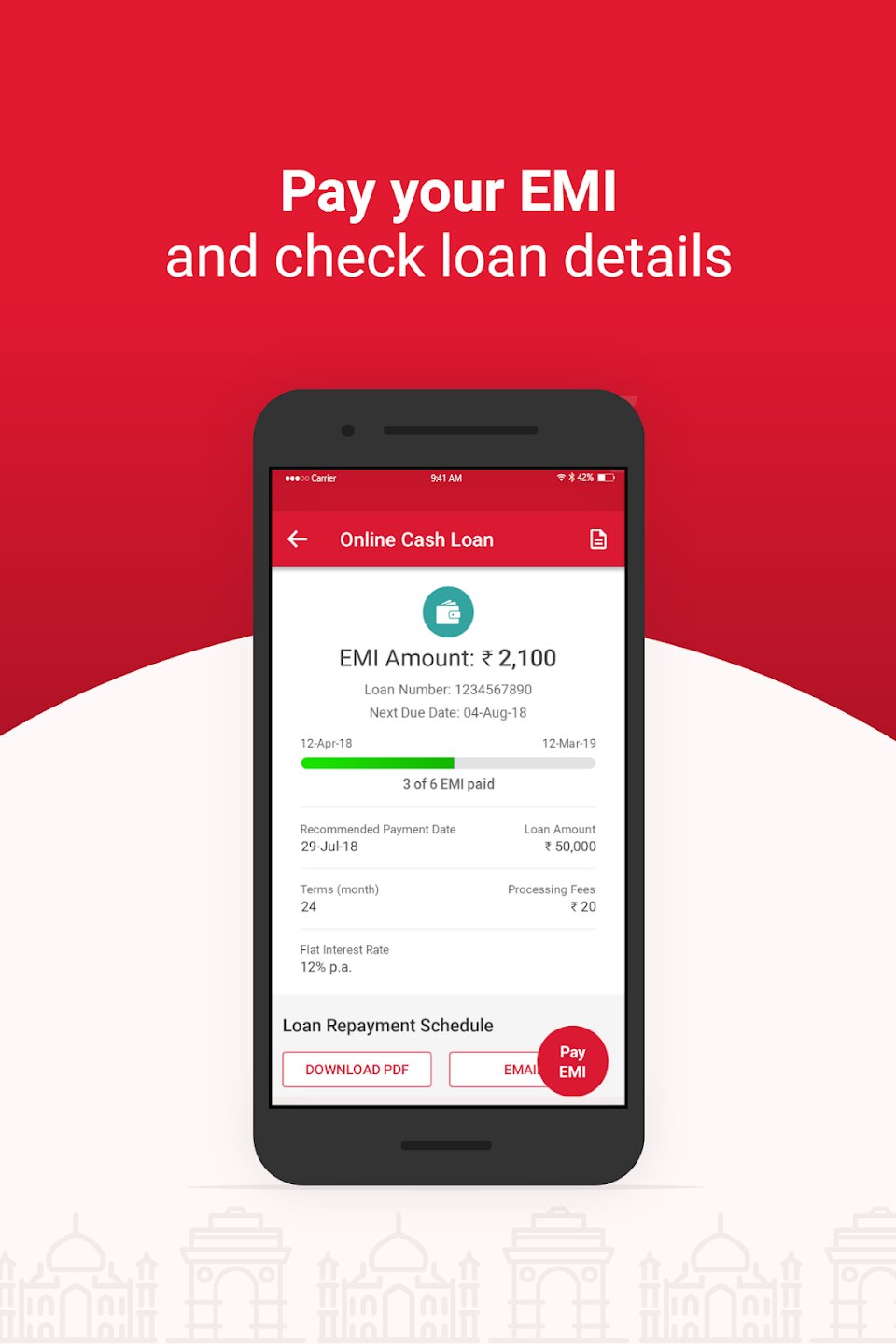

1. Dedicated section to View and download all loan-related documents like Loan Summary, Repayment Schedule, Ujjwal Card Monthly Bill, No Due Certificate etc.

2. Pay your EMIs Online through debit card, net banking or UPI

3. Check your Loan details like EMI, due date, loan tenure etc.

4. Daily Horoscope & Games

Eligibility & Documents Required

1. You should be an Indian

2. Your Age requirements :

● Existing Home Credit Customers: 19 - 69 years

● New to Home Credit: 19 - 68 years

● Ujjwal Card EMI Solution: 18 - 65 years

3. Should have a PAN Card as valid ID Proof and Indian citizenship residential address proof

4. Should have an active bank account (for the amount disbursal)

5. Should be salaried, self-employed or pensioner

Why Choose Home Credit App for Personal Loan?

✔ Disbursal within 24 hours

✔ 100% Digital Process

✔ A seamless digital experience, from loan application to repayment

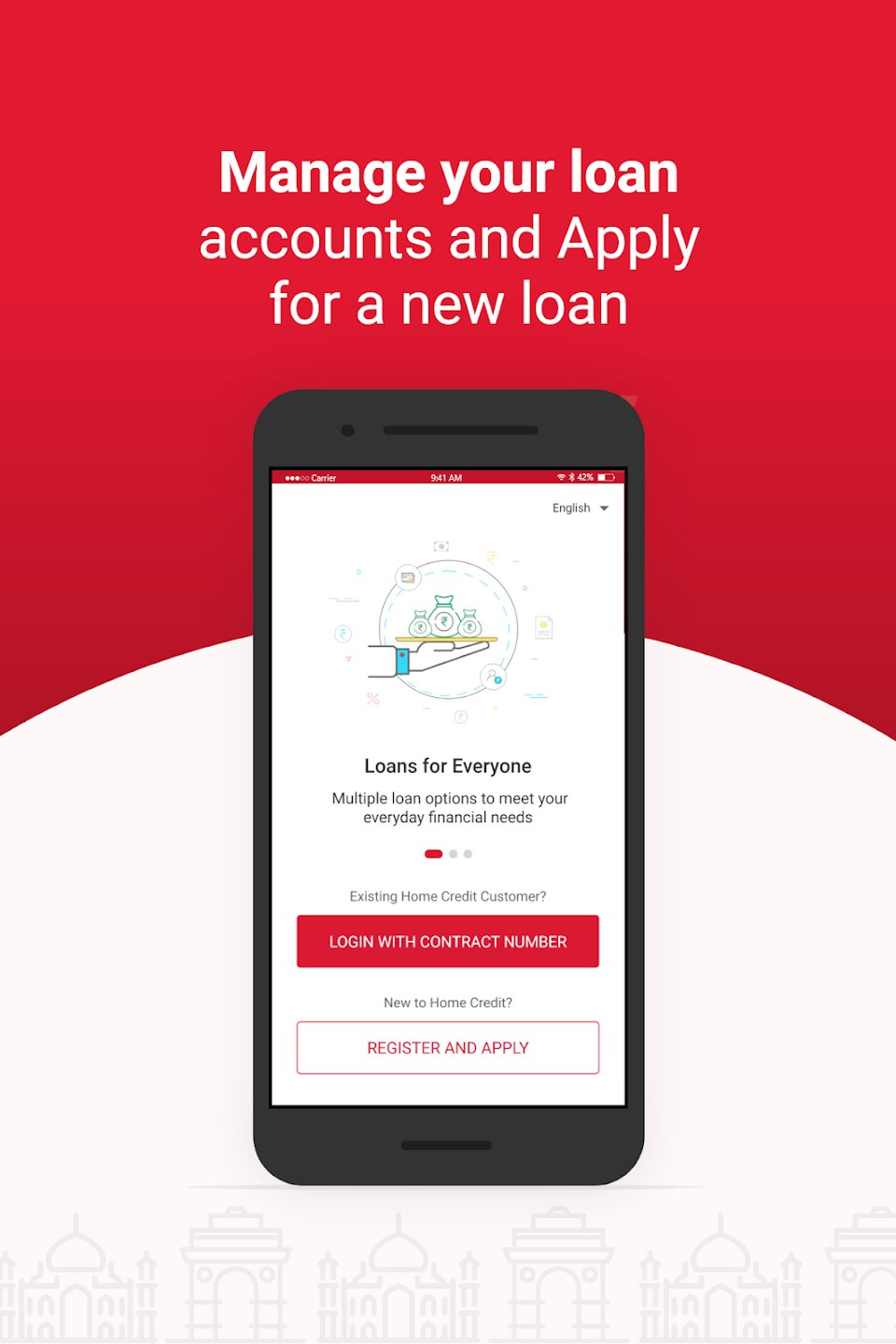

How to Apply for Online Personal Loan?

Simple & hassle-free loan application process in a few easy steps:

1. Download Home Credit App from Play Store

2. Register on the App

3. Submit your personal loan details

4. Upload KYC Documents

5. After loan approval, receive money in your bank account

So, if you’re looking for an Instant Personal Loan in India, we’re here to help you with our easy application process and 5 mins loan approval.

We are India’s leading & most trusted NBFC in lending and finance.

Related Apps

-

Crossfit Collective

by Mobiman

1290 -

AOTD

StockEdge

by StockEdge

1108 -

AOTD

eCashGenie

by Sachin Seetharam

2215