Description

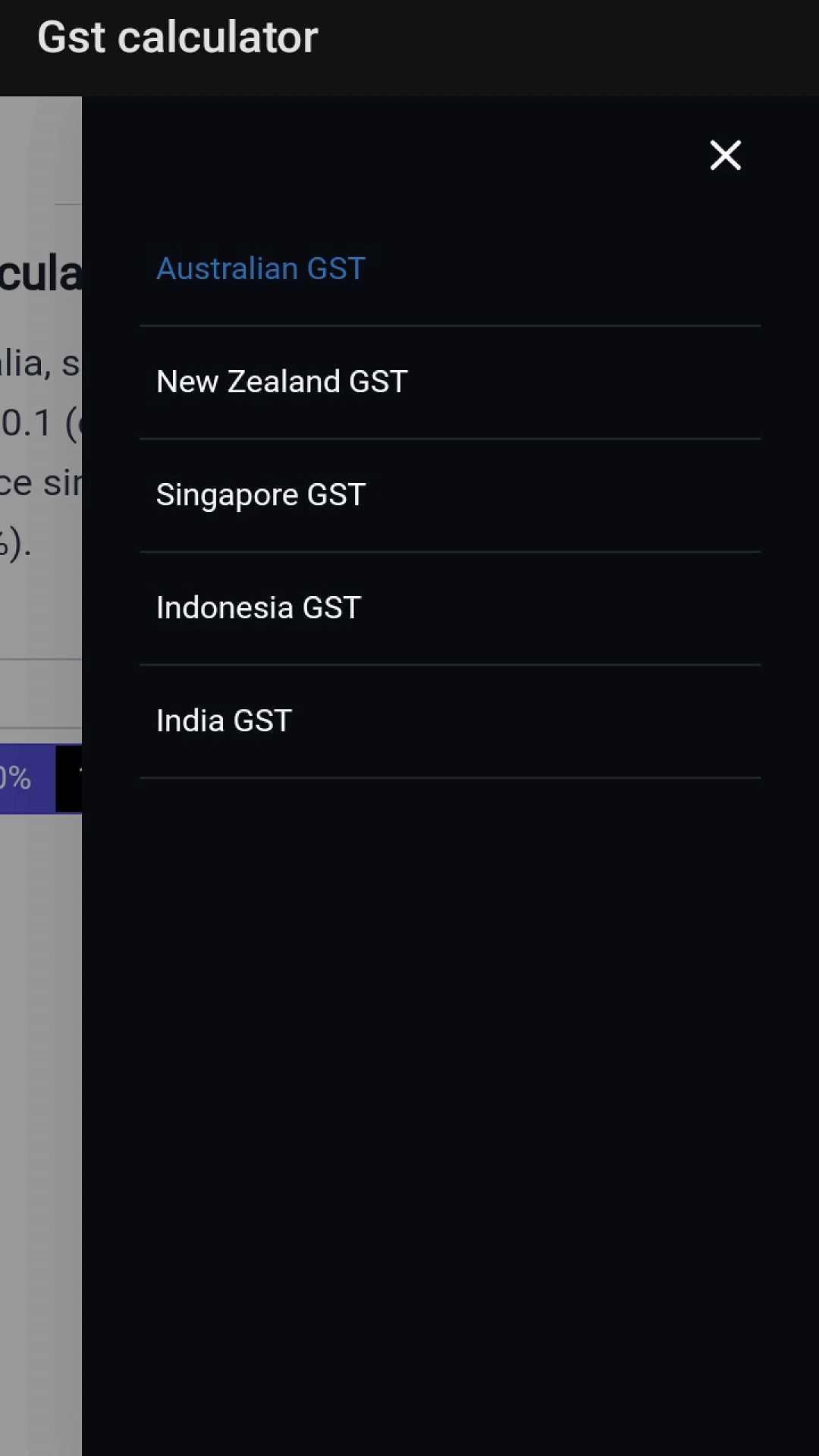

GST Calculator - All Countries GST Calculator is a useful calculator that permits you to calculate your GST in India, Australia, New Zealand, Singapore, and Indonesia. It offers a user-friendly interface and a variety of features that can help users manage their finances efficiently.

Any business registered for GST (Goods and Services Tax) in India, Australia, New Zealand, Singapore, and Indonesia should use a GST app, regardless of size or industry.

What is GST (Goods and Services Tax):

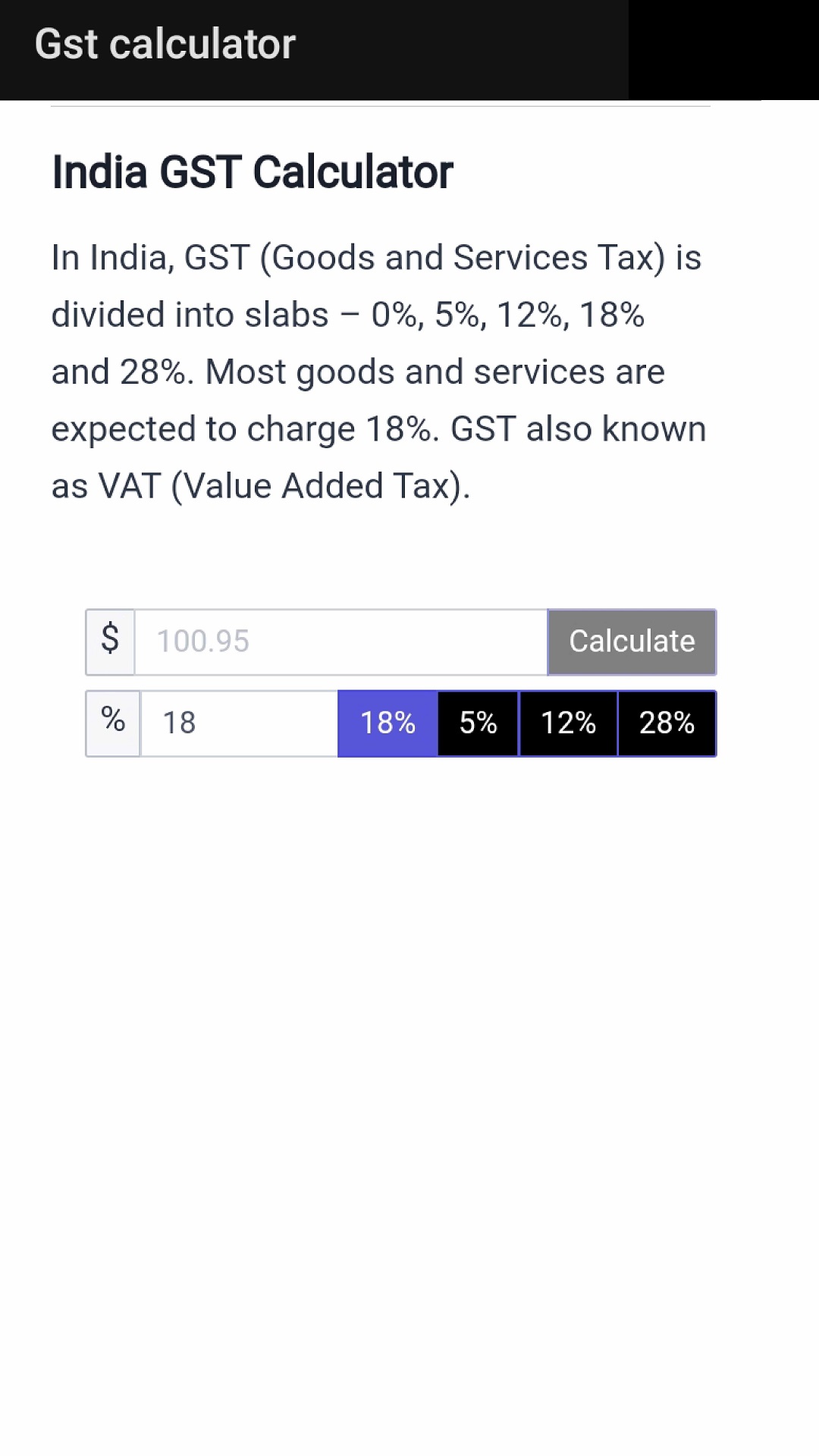

GST is an indirect tax levied on the supply of Goods and Services. Every Country has a different GST rate. GST (Goods and Services Tax) in India is divided into slabs – 0%, 5%, 12%, 18%, and 28%. Most goods and services are expected to charge 18%, Singapore has 8% GST, New Zealand has 15% GST (Goods and Services Tax), Australia has 10% GST, and Indonesia has 11% VAT applied to Goods and Services. But only registered businesses can charge GST.

When I need to register for GST

In India: Your yearly threshold must be increased by Rs. 20 Lakhs to apply for GST.

In Australia: Your yearly threshold must be over $150,000 to apply for GST.

In New Zealand: Your yearly threshold must be more than $60,000 to apply for GST.

In Singapore: Your yearly threshold must be more than $1 million to apply for GST.

In Indonesia: Your yearly threshold must be more than 4.8 billion Indonesian rupiahs (IDR) to apply for VAT.

How to Calculate GST?

India, to include GST, you can use this formula:

• GST Amount = (Original value * GST%)/100.

• Price to be charged = Original value + GST Amount.

Exclude GST Amount:

• GST Amount = Original value – (Original value * (100 / (100 + GST% ) ) )

• Net Price = Original value – GST Amount.

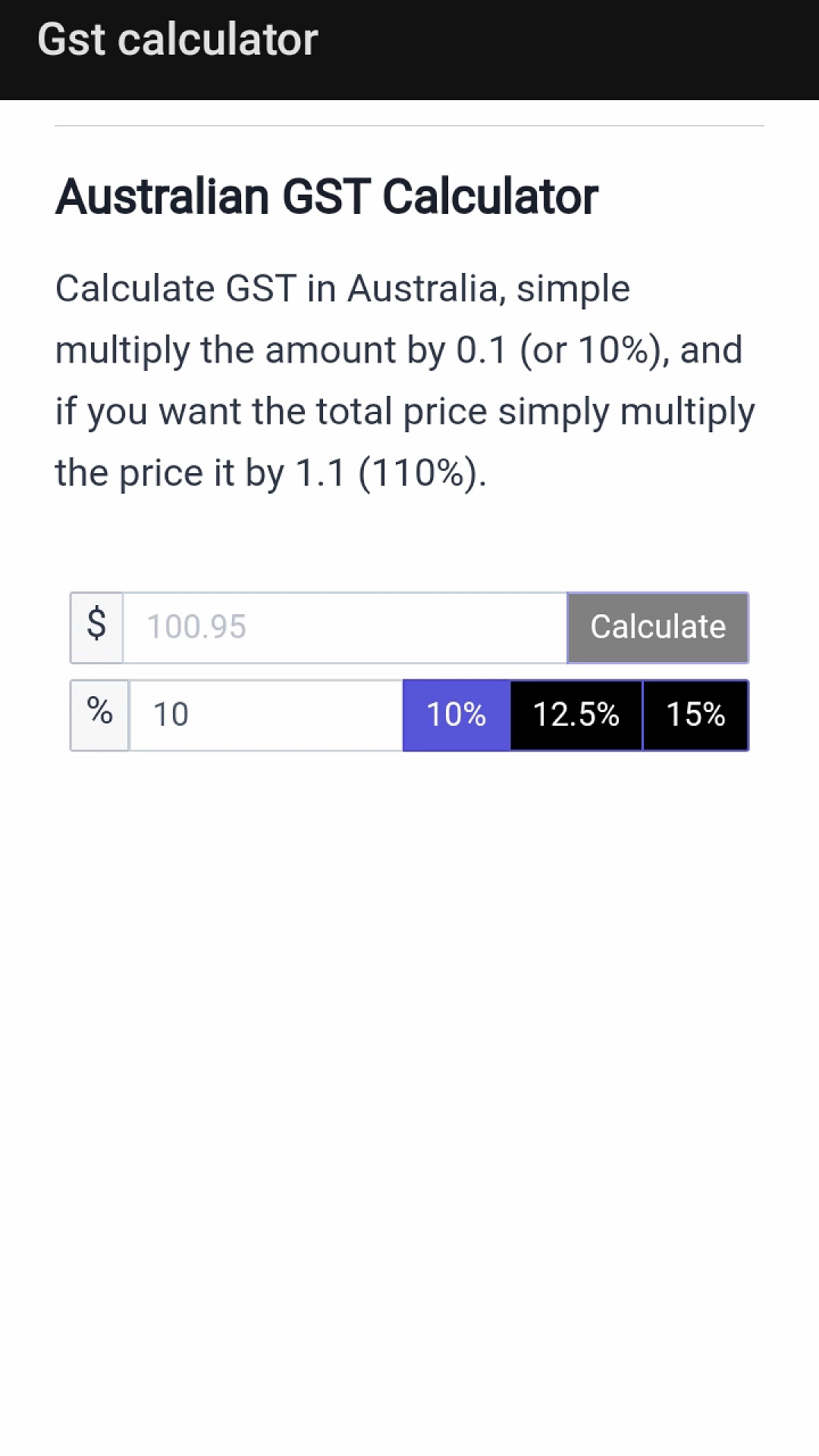

Australia GST formula:

If you find both (Add and Subtract), GST paid on a $50 product and the GST-exclusive price of a $50 product, simply follow the following steps

• $50 divided by 11 = $4.54.

• $4.54 is the GST.

• To find the GST-exclusive price, multiply $4.54 by 10, which gives us $45.4.

• The GST-exclusive price is, therefore, $45.4.

https://gstcalculatorau.com/

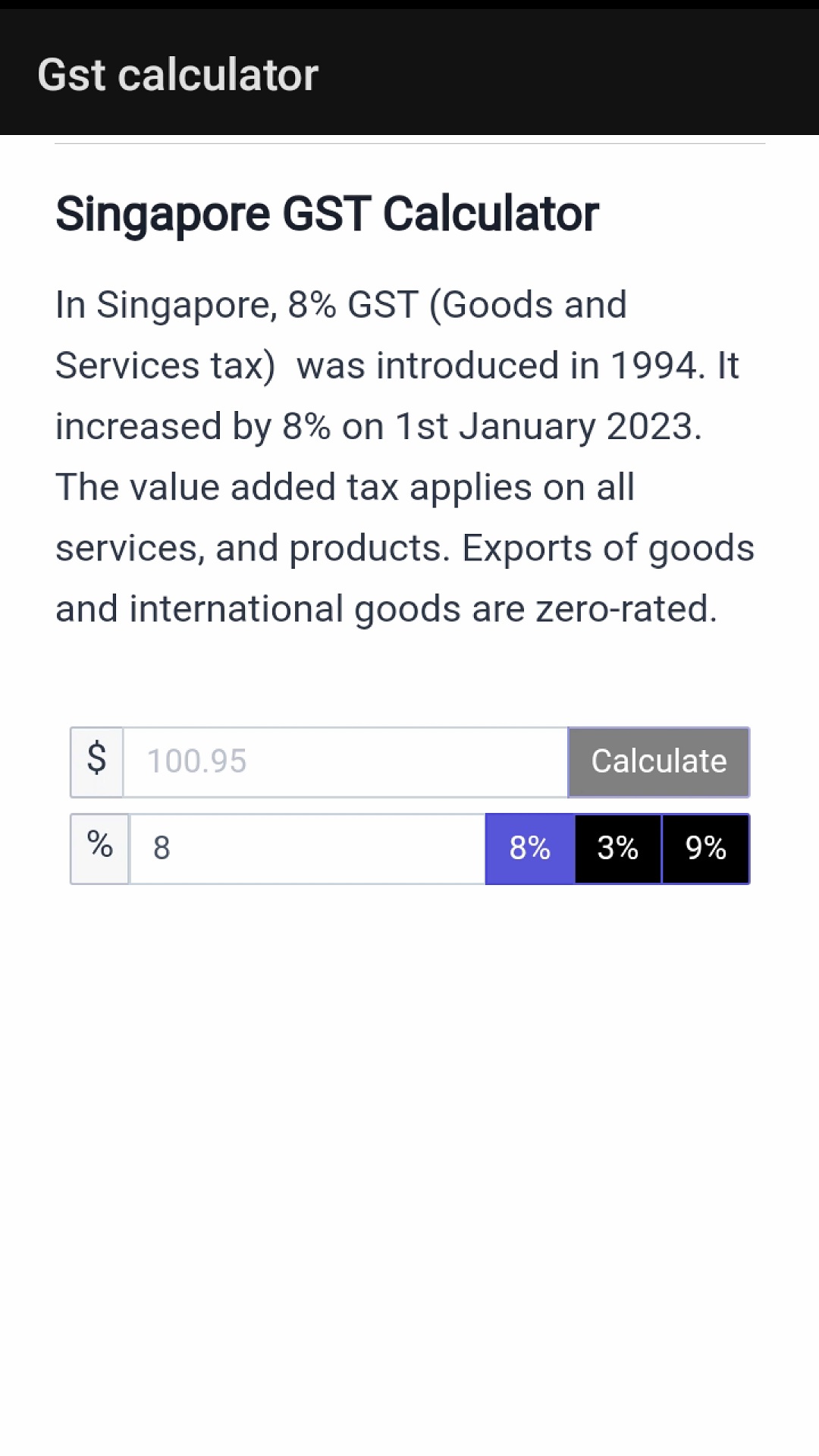

Singapore GST formula:

Calculate Singaporean GST (Goods and Services Tax) at an 8% rate. Simply multiply your GST-exclusive amount by 0.08.

• $10 is a GST-exclusive value.

• $10 * 0.08 = $0.8 GST Amount.

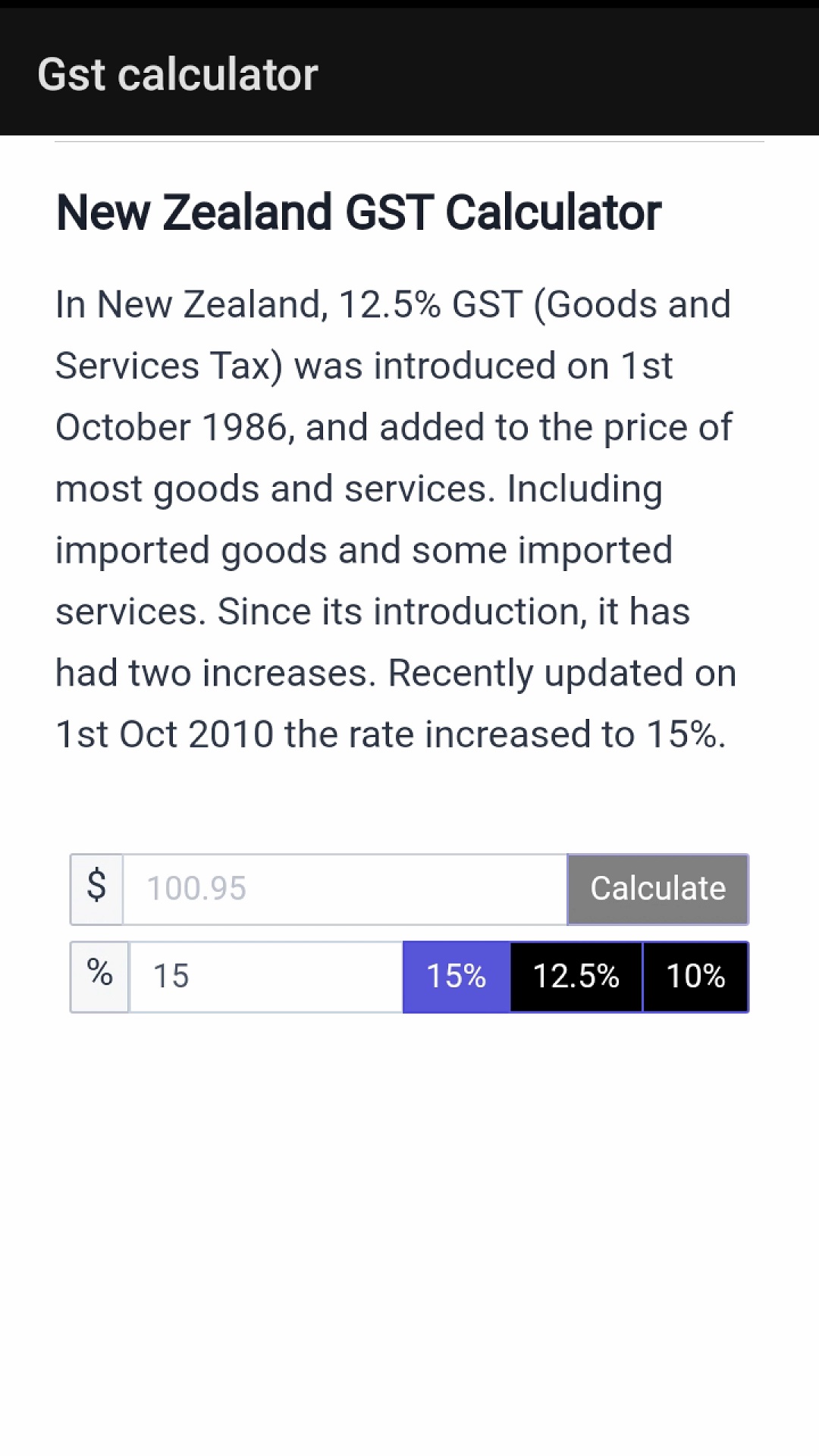

New Zealand GST formula:

1. To determine how much GST tax wax is included in the price, multiply the GST-inclusive price by 3, then divide by 23 ($10*3/23=$1.3).

2. To work out the price without GST, you must divide the amount by 1.15 ($10/1.15=$8.7).

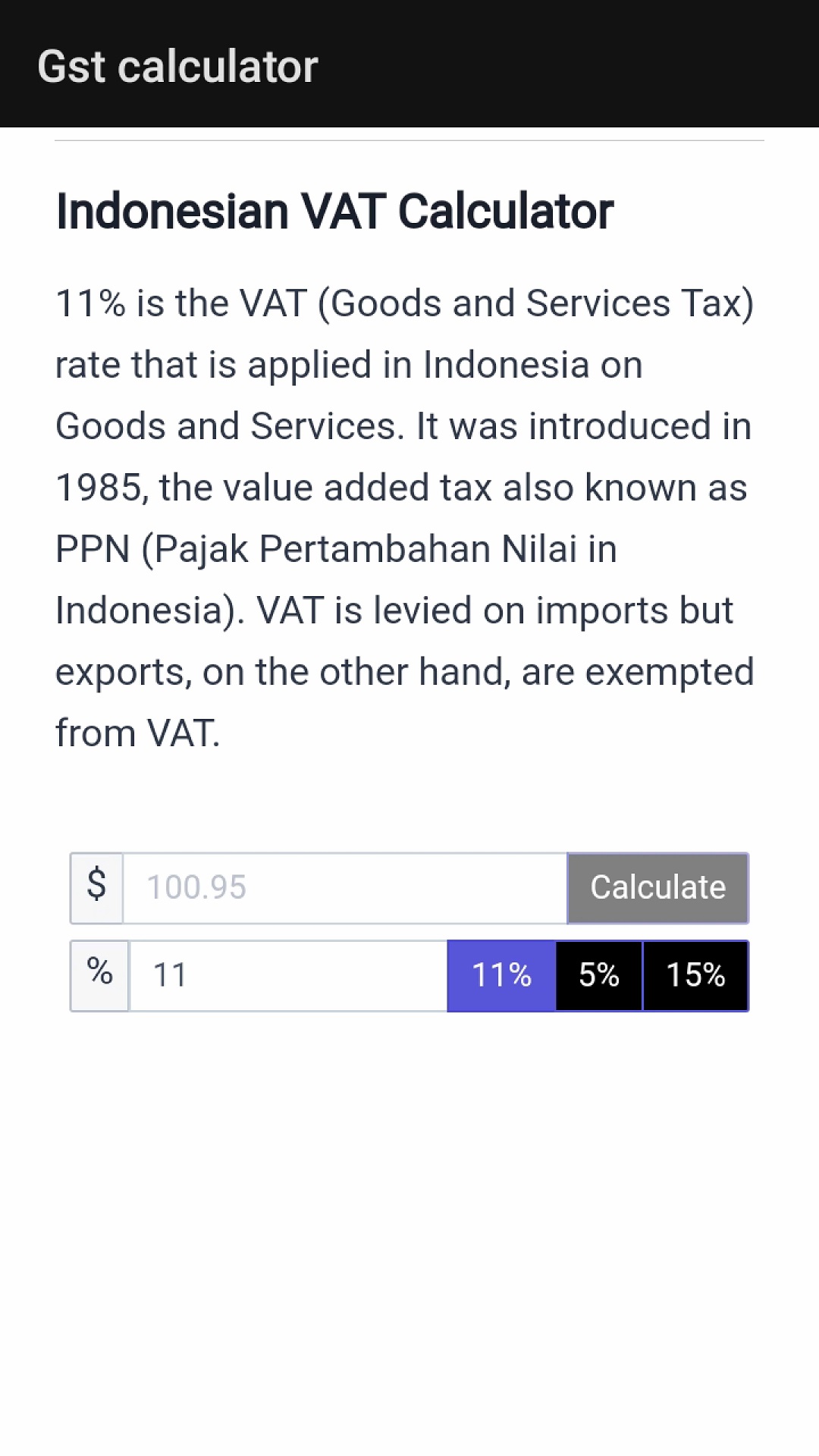

Indonesia VAT formula:

• To add Tax to the amount, here’s the formula:

o Tax Amount = ( Original Cost * VAT% ) / 100.

o Net Price = Original Cost + Tax Amount.

• To remove the Tax from the amount:

o Tax Amount = Original Cost – ( Original Cost * ( 100 / ( 100 + VAT% ) ) ).

o Net Price = Original Cost – Tax Amount.

The GST calculator helps solve the following problems:

• Helps calculate the amount of GST to be added or reduced from a given amount, simplifying the calculation process.

• Helps businesses and individuals comply with the GST regulations and avoid penalties for non-compliance.

• Reduces errors in GST calculations, ensuring accurate tax payments.

• Saves time and effort in manual GST calculations, making the process more efficient.

• Helps individuals and businesses stay updated with the latest GST rates, avoiding confusion and errors in tax payments.

Main Features in the App:

GST Calculator has various features to assist users with their financial needs. It includes:

• Users can add a percentage % value if they need to calculate GST according to their requirements.

• Users can easily copy & Share the calculation.

GST Calculator is an excellent app that offers multiple features to help users in India, Australia, New Zealand, Singapore, and Indonesia to manage their finances effectively. It provides access to GST rates for goods and services and allows for easy calculation of GST taxes.

Related Apps

-

Memory Monitor - Disk, Storage & Processor info

by Neeraj iOS App Store

2519 -

Supportly App

by Supportly

1191 -

AOTD

Custom Navigation Bar

by Vasu infotech

1834